Shattering Market Myths: The Medallion Fund Success Story

and the Fallacy of Market Efficiency

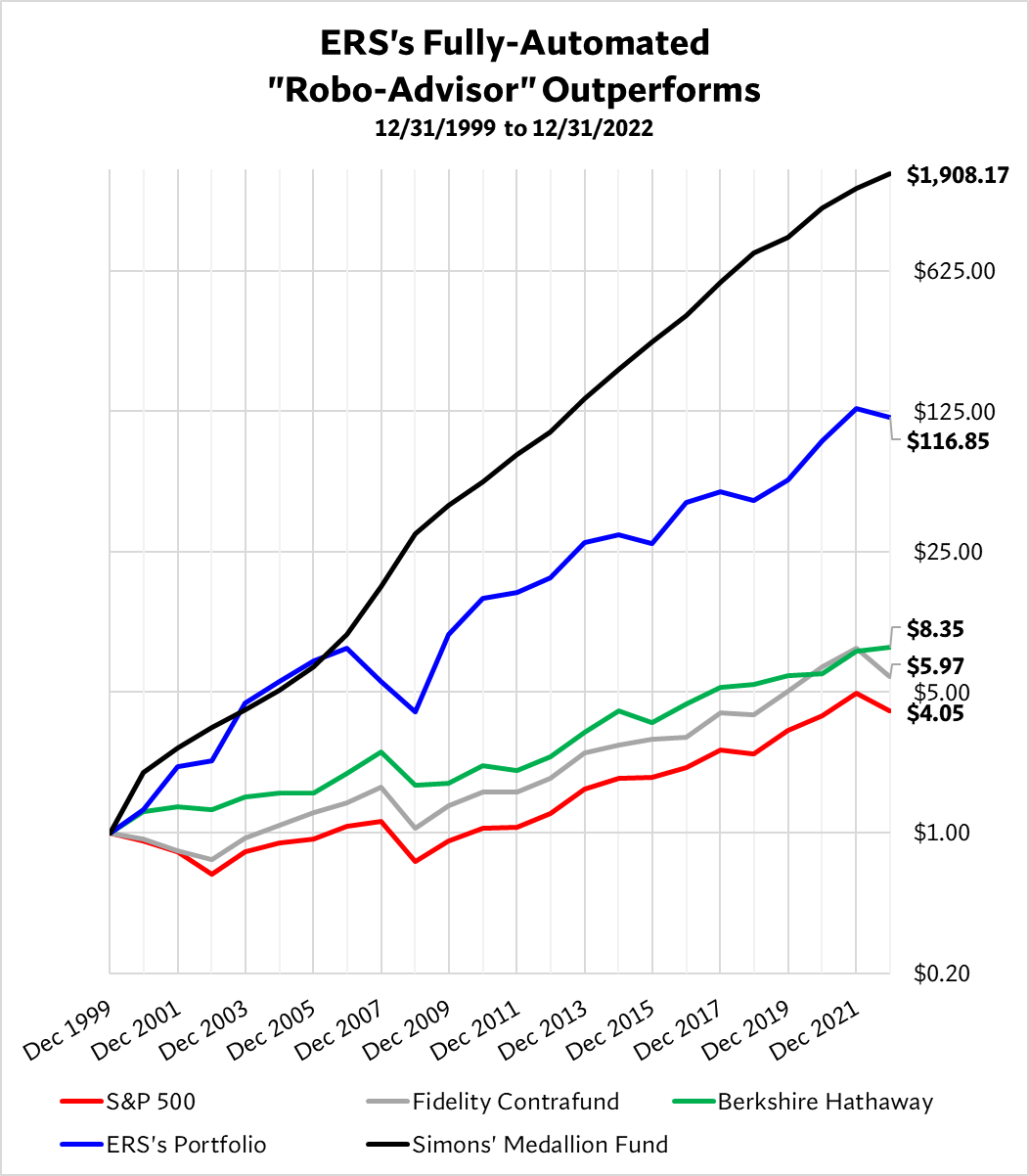

The Efficient Market Theory posits that it is impossible to consistently outperform the market due to the rapid assimilation of information by investors. Yet Renaissance Technology’s Medallion Fund, spearheaded by the formidable mathematician James Simons, Ph.D., has consistently shattered the Efficient Market Theory myth. Over an impressive span of 33 years, from 1988 to 2021, the fund has delivered a staggering average annualized return of 62%, which translates to 37% post-fees. This exceptional track record raises a pivotal question: If a hedge fund can significantly surpass market averages for decades, can we truly consider the market to be efficient? The evidence suggests otherwise.

Equity Risk Sciences has constructed a fully-automated, computer-driven “robo-advisor”. The portfolio generated by this “robo-advisor” has beat every benchmark we know of, producing a 23% average annual return over 23 years. Although it doesn’t reach the lofty heights achieved by the Medallion Fund, the performance of ERS’s “robo-advisor” is truly extraordinary, dwarfing the returns of all its peers and establishing a new standard in investment returns.

ERS’s performance examples are not outliers. They are clear, positive indicators that it is possible to not only outperform, but crush the market. This is where Grow My AUM comes in. By subscribing to our service, advisors gain access to ERS’s Alpha Algorithmics 14™, a stock selection technology proven to provide extraordinary results and elevate your investment performance.

ERS’s mission is to help you consistently beat the market and add tremendous growth to your RIA.

To learn more about how ERS can help grow your firm, contact Ray Mullaney:

(617) 684-3900

Ray@ERS.ai